Why Lab-Grown Diamond Prices Are Falling - and What the Market Is Really Telling Us

The observations shared here are not intended to challenge personal preferences or purchasing choices. They are drawn from several decades of the author's experience, observing pricing cycles in the diamond industry. It is not an argument for one product over another, but an attempt to factually describe the state of the market currently.

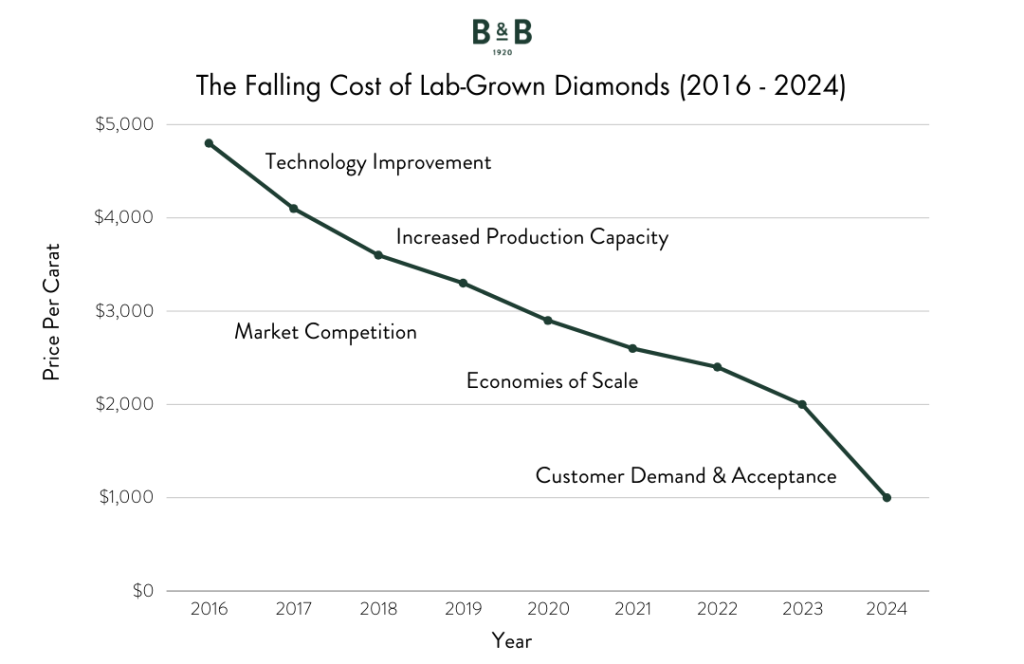

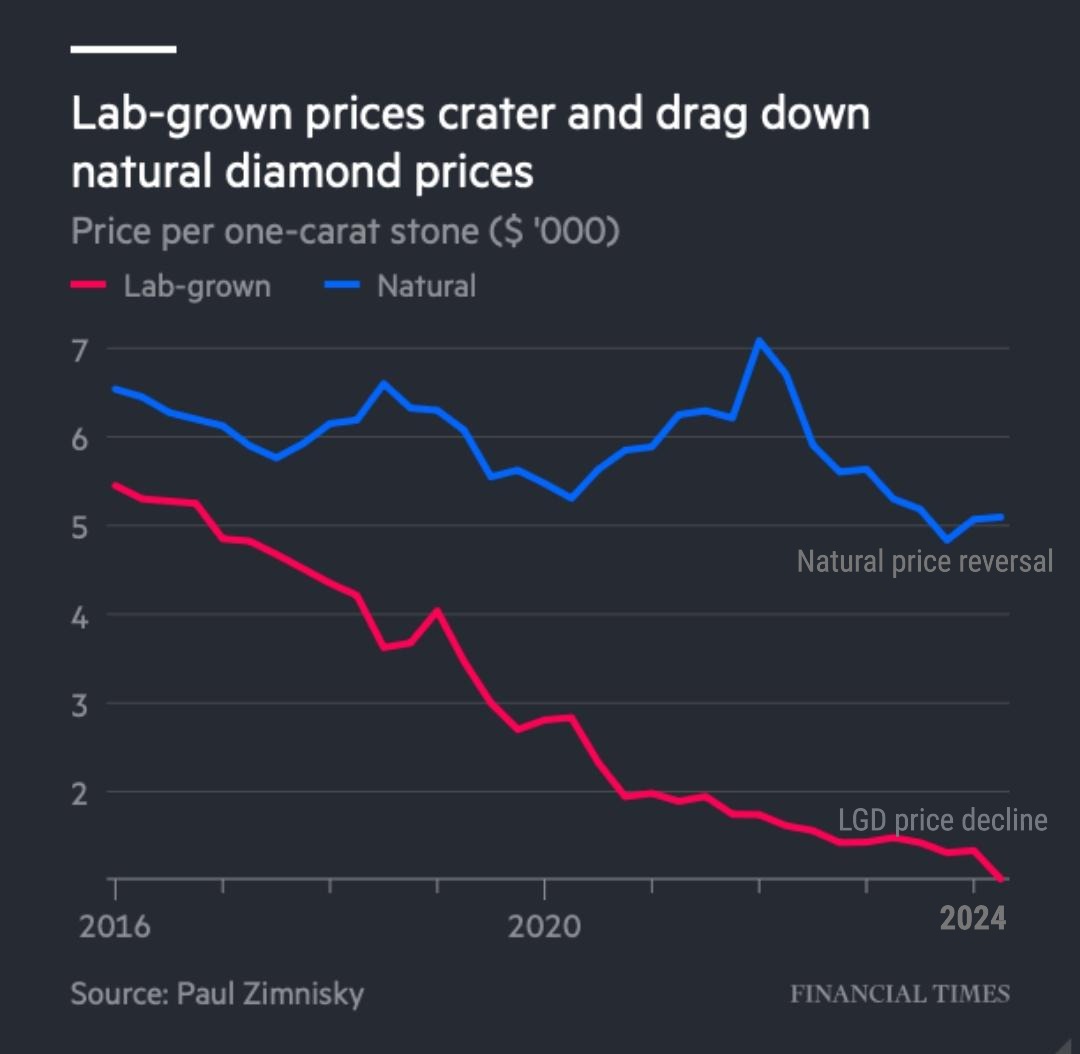

After several years of rapid growth and consumer enthusiasm, lab-grown diamond prices have declined sharply. The primary cause is quite straightforward: production capacity expanded much faster than retail demand, transforming what was widely positioned as a viable alternative to natural diamonds into a largely commoditised product. This correction reflects the early consequences of unconstrained supply growth rather than a consumer-led rejection of the product.

Alongside this price decline, consumer confidence in lab-grown diamonds is beginning to waver, creating challenges not only for rough growers and retailers, but also indirectly affecting sentiment around natural diamonds.

Since 2018, wholesale prices for popular lab-grown sizes have fallen by as much as 90–95%, while the retail price gap between lab-grown and natural diamonds has widened dramatically - from roughly 20–30% a decade ago to 80–90% today.